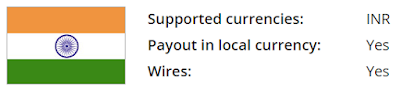

The Payoneer is one of the best payment processors in the world that offers services to send and receive international payments with low processing fees. The Payoneer is the most secure and cheap online payment processor for the freelancers. In India, the Payoneer helps the Payoneer Indians to receive the international payments by connecting to the companies and withdraw the payment to the local bank account in Indian Rupee (₹).

When comparing PayPal India and Payoneer India, the Payoneer works differently and is very safe to use. This is the Payoneer India reviews where you can learn how Payoneer India works and how to send, receive money online using Payoneer in India.

What is Payoneer?

The Payoneer is an online financial service company that offers services such as online money transfers, payment processing, e-commerce payments, etc. The Payoneer account holders can send* and receive money to the e-wallet, bank account or Payoneer prepaid Mastercard®.

Note – While the review explains Payoneer services in India, you can still choose to read the general services of Payoneer if you’re not from India.

Payoneer India Reviews:

- The Payoneer India is the service offered by the Payoneer to the Indian residents to send* and receive the international payments.

- The Payoneer account holders can receive money from the international companies to their accounts in different currencies, including USD($), GBP(£), EUR(€), etc.

- The money received will be automatically transferred to the India(n) bank account in INR(₹). The currency conversion will be automatically done based on the market price.

- The Payoneer helps us to manage invoices and receive payments manually from the approved sender/companies.

Related article – Earn free Amazon.in gift card.

Payoneer India vs PayPal India:

- Payoneer and PayPal are the best payment processors in India. Both are trusted payment processors with unique features, but one is better than the other in some features, which are discussed in this section.

- The Payoneer process payments are quick compared to PayPal.

- The Payoneer is highly secure compared to PayPal with account management. One cannot easily edit the account settings on Payoneer. We can easily change PayPal settings without restrictions.

- The name cannot be edited on Payoneer and they accept only minor corrections with proof. We can do minor corrections in the name on PayPal and major corrections are possible after contacting PayPal with acceptable reason.

- Payoneer does not allow us to change the bank account details and add more than one bank account. PayPal users are free to add many bank accounts and cards to their account without restriction.

- Payoneer India users have high restrictions in sending money to other Payoneer users. PayPal India users can send money to international PayPal users with no restrictions.

- Payoneer is the best for receiving the money in India(n) bank account at low fees. PayPal charges more fees compared to the Payoneer to transfer funds to the local bank account. Refer to the fee section for more information.

- Both PayPal India and Payoneer India account holders cannot store/hold money in their account while it is possible on Payza India.

- There is no review process in PayPal India. They instantly approved accounts on PayPal. Payoneer will approve the account only after a manual review process.

Continue to Read – PayPal vs Payoneer.

Requirements to create Payoneer Account in India:

- To start an account on Payoneer, you must have a PAN card and a bank account authorized by RBI.

- Your name must be the same in the PAN card and bank account to prevent delays in the review process.

- You must have an email address and mobile/Landline number.

Steps to Create an Account on Payoneer in India:

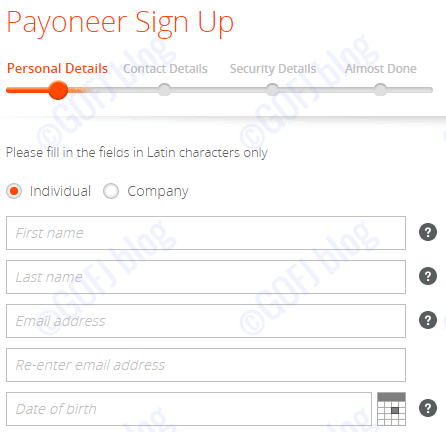

- To start the Payoneer account in India, click here – Payoneer and click sign up to start. Complete four-step registration to sign up.

- In the first step, you will be asked to select the type of account, whether it is personal or company. Then you must enter your first and last name. Make sure that the name exactly matches the name on the PAN card and the bank account.

- Enter the email address, which you cannot almost change after the setup. Enter the date of birth that will be used in the recovery process and account editing process.

- In the next step, select the country and enter the correct address with the postal code. Give your mobile number or Landline number and click next.

- Set a username for your account which should be used to log in. Set the password for your account and set up the security questions to protect your account and unlock the account during the security checks.

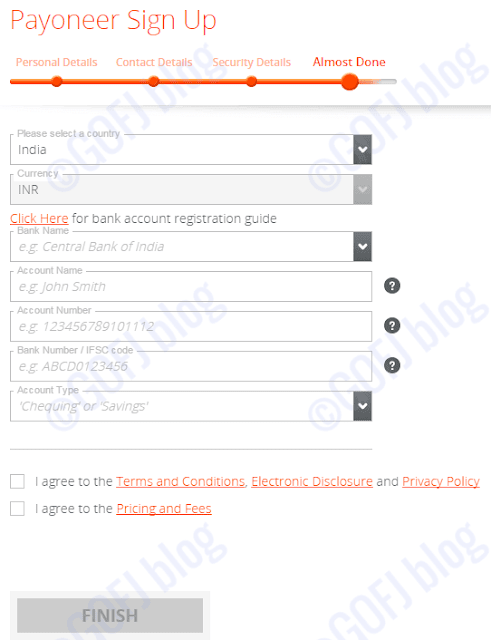

- The fourth step is the final and important step where you have to enter the bank account details to be linked to the Payoneer account. Enter the correct account type and account details to get approved without difficulties.

- Once the bank account is approved, it will be very hard to change the bank account without proper documents.

- Now the registration process is complete and the Payoneer will review your account and you will receive an email if they approve the application, as shown below.

- Once approved, you can log into your account and proceed with other formalities.

Payoneer Account Setup:

Adding the PAN card to the Payoneer Account:

- Once the registration process is complete, enter additional details to unlock the limitations in the Payoneer India account.

- According to the RBI guidelines, the Payoneer users must enter their PAN number to receive and withdraw funds to the linked bank account.

- Enter the correct PAN number and click update.

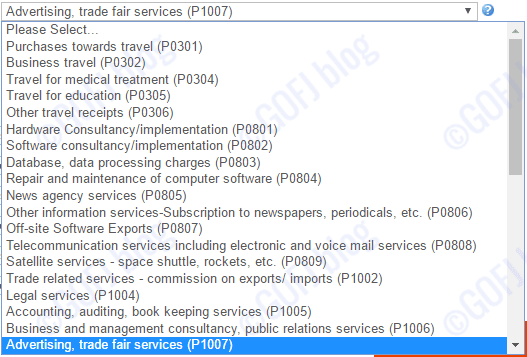

Choosing the Purpose Code on Payoneer India:

- It is mandatory that Payoneer India account holders should enter the purpose code to withdraw money to the bank account.

- There will be different purpose codes given on the drop-down menu. Read carefully and select the appropriate Payoneer India purpose code.

- If you do freelance jobs or work on sites like Ysense, Fiverr or CPA affiliate networks, select Advertising. If not, choose a different purpose code.

- Now your account is unlocked for sending and receiving payments through Payoneer.

You might enjoy reading – Sites to earn Flipkart gift cards.

How to Receive money to the Payoneer India Account:

- Unfortunately, the Payoneer India account holders cannot receive direct funds or personal money. You can only get money from the approved sender for which you must link your Payoneer account to the funding source.

- We cannot receive money(Indian transactions) using email ID as we do on PayPal and Payza.

Linking Funding Source to the Payoneer India Account:

- If a site pays through Payoneer, you can easily link the funding source to the Payoneer account.

- To add the funding source, select the Payoneer as the payment option on the site from which you want to receive the funds.

- You will be redirected to the Payoneer payment page, where you have to log in to confirm the funding source.

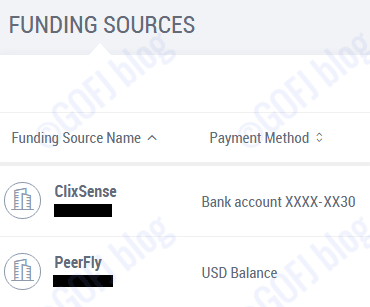

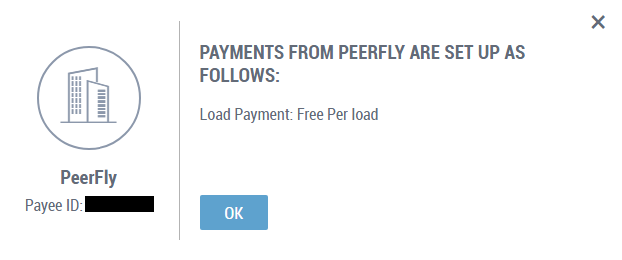

- Once you log into your account, review the funding source you’re going to link and confirm. I’ve added Peerfly for example which is a premium affiliate network for webmasters.

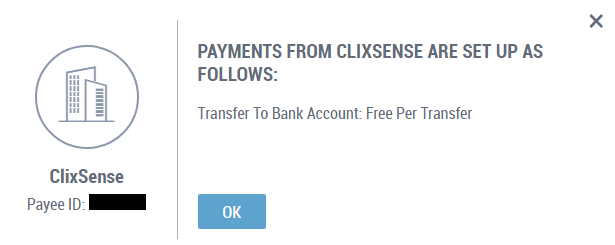

- We can add unlimited funding sources to the Payoneer account. We can manage the funding sources in the account settings. Clixsense(Ysense) has also enabled the Payoneer Payment.

Receiving funds and withdraw to Payoneer India Account:

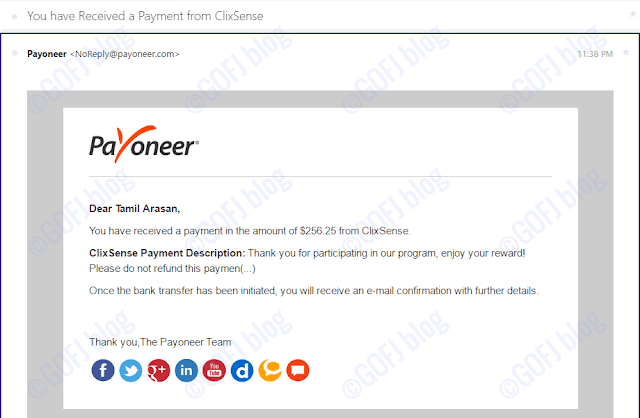

- When you request for payment on the linked site. They will process the payment according to their terms. Once funds are sent, it will be immediately loaded in the Payoneer account.

- Payoneer will email regarding the fund transfer, as shown in the image given above.

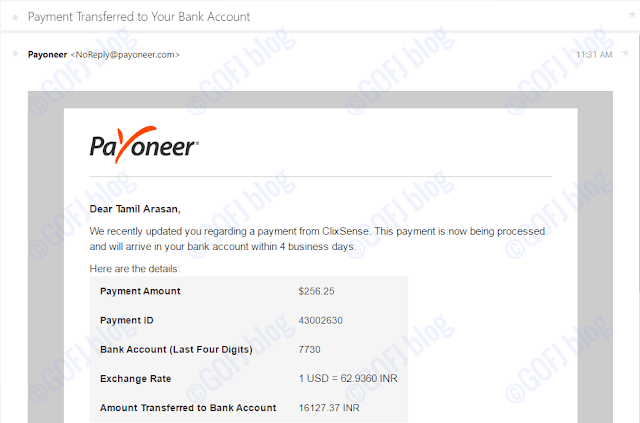

- As I’ve said previously, Payoneer account holders in India cannot hold the funds in the account. Payment will be immediately transferred to the bank account in the Indian currency.

- Payoneer will automatically convert the USD or other currencies into the Indian Rupee based on the market price on that day.

- The transferred fund will take up to 5 days to appear on the bank account statement.

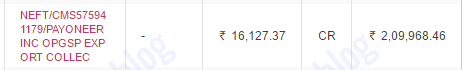

- The image given above is the bank account statement with payment transferred by Payoneer.

Related article – Paid survey panel that pays via Payoneer.

How to Send Money from Payoneer:

- Unfortunately, Payoneer India account holders cannot send money/make a payment to other Payoneer users in India and International users.

- The send money feature has been disabled in Indian accounts.

- However, sending payments using the Payoneer business account is very simple. To send a payment, we must click the pay button on the menu.

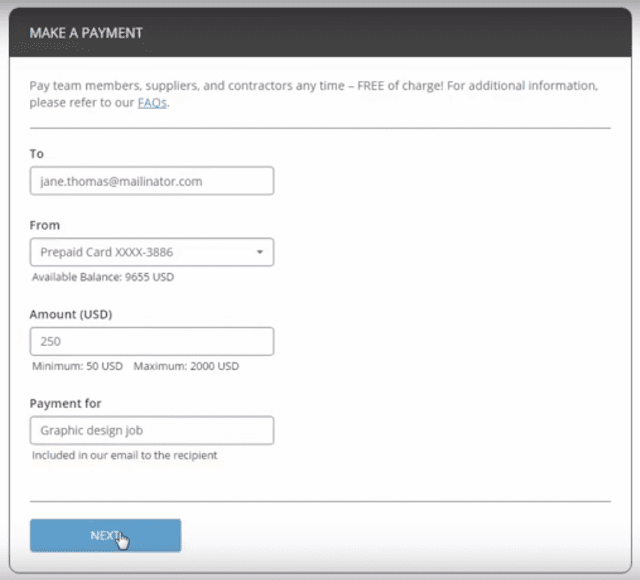

- In the make a payment page on Payoneer, we should enter the receiver email address. Select the source of sending payment. Enter the amount to be sent and click next.

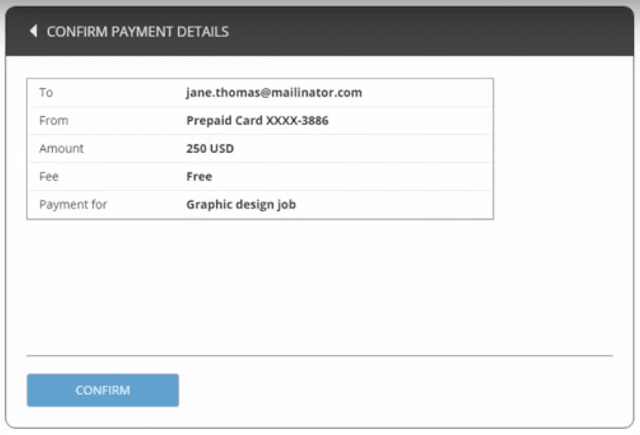

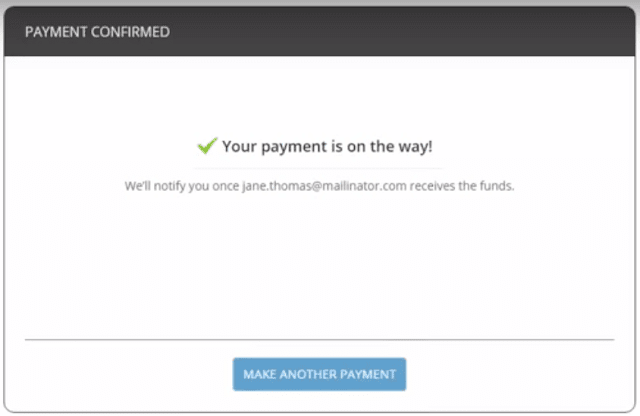

- The sender will be asked to confirm the details. Once verified, the confirm button should be clicked.

- The Payment sent notification message will be displayed. They will transfer the funds within 2 hours.

- The sender can make a payment to the person without a Payoneer account. The receiver should create an account to accept the payments.

- Payoneer mass payout can be done for a higher number of transactions.

Payoneer Fees Structure:

- The Payoneer will charge a small amount of fee for loading funds* and receive payments to the bank account. The transfer fee is charged only for selected funding sources. Few sites send a payment for free of cost.

- To learn the fee structure, go to the funding source and click the source to find the fees.

- The transaction fees and other fees are listed in the table given below.

You might also like this – How to sell Bitcoin at low fees.

Payoneer India Transaction Fees structure to Send and Receive Funds:

| Transaction nature | Receiver | Sender | Remarks |

| Standard Loading | Free | N/A | No |

| Immediate Loading | $2.50 | N/A | No |

| Card activation | $5.00 | $5.00 | Selected countries |

| Monthly Card Maintenance | $3.00 | $3.00 | $1 for 2+ transaction |

| Withdrawal fees | 2.00% | N/A | No |

| Currency conversion | 2.00% | 2.00% | Mid-Market price |

| ATM withdrawal | $1.35 | $1.35 | Per transaction |

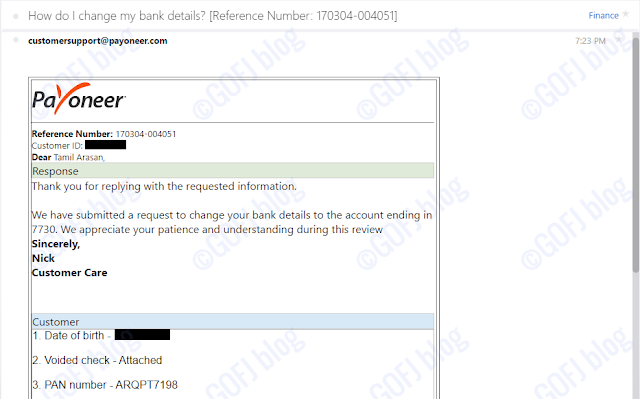

How to Change Bank Account Details on Payoneer in India:

- The Payoneer India users cannot change the bank account details in their account as we do it on PayPal. The PayPal allows us to add, remove bank account anytime provided manual confirmation should be completed.

- The Payoneer is a step ahead in security, which does not allow users to add or remove bank account in the settings.

- But adding a new bank account is possible by submitting the documents or voided check leaf.

- To change the bank account details or to replace the existing bank account, you must contact the Payoneer’s support with the reason for changing the bank account.

- The Payoneer support will remove the linked bank account and will ask you for the documents of the new bank account or voided check, date of birth and PAN details.

- The name on the bank account should match the name on the Payoneer account.

- After the review, the new bank account will be linked to the Payoneer account. However, you must add the preferred bank account during the signup process to prevent confusion.

Payoneer Mastercard® in India:

- The Payoneer Mastercard® is not available for the regular account holders in India. However, business account holders can apply for the Payoneer Mastercard® by submitting the details.

- The business should make a payment of at least $10000 a month in total.

- The Payoneer Mastercard® helps us to pay for others.

- Payoneer will send the Mastercard® for free after verification which can take up 12 – 28 days.

Payoneer Affiliate/Referral Program:

- Payoneer pays $25 for referring friends and other people to Payoneer.

- Once the approved account holder receives $100 to his/her account, the Payoneer will pay $25** to the referrer and the referral.

**Minimum payment to collect referral rewards should be received within a month.

Limitations in Payoneer India Services:

- The Payoneer India users have high restrictions in using the services because of security measures and the Reserve Bank of India guidelines.

- The Payoneer account holders cannot store/hold money in their accounts.

- The regular Payoneer India account holders cannot send money to others.

- Payoneer users cannot change the bank account often without the proper reason(s).

- To use Payoneer, the PAN number and bank account are a must. Payoneer MasterCard is not available for regular account holders.

Advantages and Disadvantages of Payoneer India:

Pros of Payoneer:

- Payoneer is one of the most secure payment processors to receive International payments.

- Payoneer is highly secure.

- The Payoneer process International payments for fewer fees compared to other payment processors.

- The Payoneer process payments quick. They might transfer the payments from the international account and send to the bank account within a day or two.

- Payoneer allows receiving the payments in India by linking to the funding sources. So, there should be no worries about giving the wrong payment details.

- Many online job sites and affiliate networks to process payments widely used Payoneer.

- Payoneer is accepted in over 220 countries worldwide.

Cons of Payoneer:

- Payoneer is not user-friendly like PayPal and other payment processors.

- Payoneer account holders have less control over the changing account settings.

- One cannot easily add or remove a bank account on Payoneer.

- Very fewer services provided for the Payoneer India account holders.

- Payoneer India users cannot hold money in their account and withdraw as per the wish.

- Payoneer India users cannot send money to others.

Click here to create an account – Payoneer.

You might like this comparison – PayPal vs Payoneer.