PayPal is the best and most trusted online payment processor in the world. PayPal allows us to send, receive money all around the world and we can use PayPal to buy products & services on international sites and accept payments for business. It is the first trusted online payment processor to create a revolutionary service to transfer money anywhere from the world within seconds, replacing checks and direct transfers.

PayPal has re-started its services in India, which has several outstanding features. PayPal India is a gift for the online freelancers, bloggers, companies to receive payments from the overseas countries quick. This article explains how PayPal India works and guides to send and receive money using PayPal India accounts.

What is PayPal?

PayPal is the world’s largest payment processor established in 1998. PayPal allows us to send and receive money anywhere in the world for personal and business purposes. And apart from sending and receiving money, PayPal acts as an online wallet to store money*.

Top 10 List – Best Payment options for Freelancers.

PayPal India Review:

About PayPal India:

PayPal India is the service provided by PayPal in India only for the Indian residents. PayPal India provides country-specific services like sending money to users of other countries in their currency like USD($), GBP(£), EUR(€), etc and receiving the money to the Indian bank accounts in Indian Rupee(₹).

Related article – Payoneer India Review.

Benefits of Using PayPal:

- PayPal helps us to send and receive money all over the world. The PayPal transactions are instant that the money will be sent and received within seconds.

- PayPal allows us to transfer even a little amount of money. Users can send and receive even $1 or less from international customers. This is impossible with direct deposits and wire transfers.

- The PayPal transactions can be done at a high speed for a low cost while the bank transfers will take a few days and the fees will be higher to complete the transaction.

- PayPal can be accessed by sitting at home or anywhere using the PayPal app on smartphones.

- Apart from sending and receiving money directly, PayPal helps online shoppers to buy products from international shops with buyer protection.

- PayPal automatically transfers the incoming funds to the local bank account in the home currency, no matter whatever currency we receive.

- PayPal is highly secure and easy to use compared to other online payment processors.

Requirements and Eligibility to become a PayPal India Member:

- PayPal has come up with a set of rules after restarting its services in India. If you want to use PayPal services, you must fulfill all the requirements.

- To start a PayPal account, you must have a valid email address. Mobile number is optional but to protect your account you must link your mobile number to the PayPal account.

- You must have a bank account in RBI authorized banks to send and receive money.

- You must have the PAN card to get your account verified. No transactions can be made without proper verification.

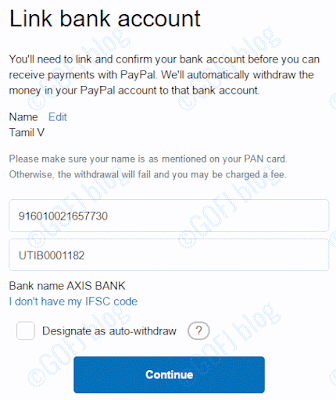

- The name on your PAN card, bank account, and PayPal account should exactly match. Make sure you check your name on the PAN card and bank account while starting the account on PayPal.

How to Start a PayPal account in India:

- To start a PayPal account – Click here. On the PayPal home page, click sign up to start.

- Select the Personal account to start the account as an individual. If you’re an online business, select the business account and click next.

- On the next page, you will be asked to enter your country, email address and create a password to protect the account. When done, click next.

- The third step is the most important step where you should enter all your banking details. Enter your name as given on the bank account(which is almost impossible to change in future), enter your residential address. You will be asked to enter the date of birth, which is important. You cannot change the date of birth once the account is created. The date of birth should be submitted to keep your account if you lose your password. Enter your mobile number and click next.

- In the last step, you will be asked to link your credit card or debit card. You can link your card during the sign-up process or you can do it later. I recommend not to add the card details unless you’re going to make any purchase.

- Now the registration process is complete, verify your email to proceed.

How to Verify PayPal India Account:

- To send and receive money, your PayPal account must be verified. Most of the online job sites will not pay you if your PayPal account is unverified.

- Verifying your email and mobile phone number will not make the PayPal account verified. You must link your bank account or credit/debit card and PAN number to get your PayPal India account verified.

- Reserve bank of India(RBI) has made these steps mandatory to prevent unauthorized illegal transactions. Without a PAN card and bank account, you cannot verify your PayPal account. In such a case, you can create a PayPal account for your Family members.

- The steps to verify the PayPal account is given below.

Adding and Linking Bank Account to PayPal India Account:

- After registration, log into your account and set the security questions, which will be used to verify if you forget the password.

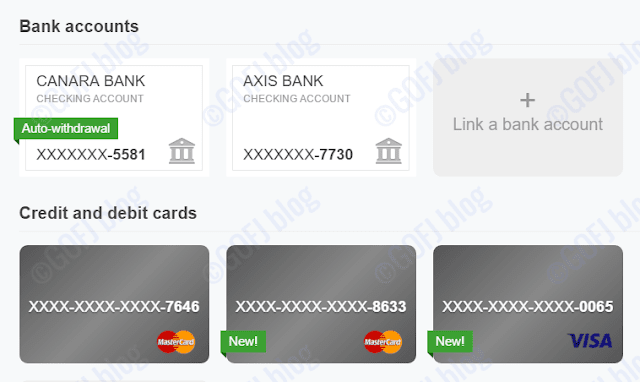

- In the account menu, click payment methods. A page will appear similar to the screenshot given below.

- Now click the link bank account button. You will be redirected to a page as shown below.

- You have to enter your bank account number and bank ISFC code. Click designate as auto-withdraw to set this bank account to enable auto withdrawal. If you link only one bank account, it will be considered as default and the funds will be automatically withdrawn to that bank account as per their terms.

- Now the bank account is linked to the PayPal India account and it should be verified again. You must confirm your bank account after adding the bank details.

- You will receive a mail later asking you to check your bank account for two small deposits. Wait until you receive deposits from PayPal. The example of the PayPal deposits to confirm the bank account is given below.

- You can find the PayPal deposits in the images given above. They have deposited ₹1.01 and ₹1.04 respectively in the linked bank account.

- If you’ve received the funds, go to your PayPal account and click the bank account linked with “ready to confirm” as shown above.

- You must enter the amount received in the bank account in the two boxes as shown above and click confirm.

- Now your Indian bank account is confirmed by PayPal India. When you go to the payment methods, you can find the account is confirmed. Also, you will receive a mail regarding the change.

- You can add more than one bank account and choose any bank to withdraw the incoming funds. We should make one of your bank accounts default for automatic transfers the funds within the limited time.

Adding and Linking Credit or Debit Cards to PayPal India Account:

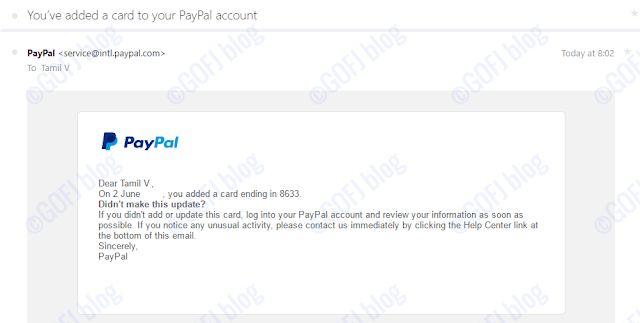

- Linking the credit or debit card will allow us to purchase online products & services faster and safer. To link credit or debit card, go to the payment methods and click, link a card. Add the card details.

- PayPal will make a small charge to the card. A four-digit code will be found on the card statement.

- The code should be entered in the box given to confirm that the card is under the user control and not others as shown above.

- Once the card is successfully linked, PayPal will send an mail reminding the changes made to the PayPal account.

- There are no limitations in adding the cards to the PayPal account. You can add cards from different banks and other people until you have control over the card.

- While paying through PayPal, you will not be asked to enter the OTP or verified password. The money will be debited once you click to pay. So, be careful about account security.

Banks that Supports Credit and Debit Card Payments on PayPal India:

PayPal India only supports debit and credit cards of certain major banks. This table will help you spot your bank. PayPal only accepts only major credit and debit cards which include Mastercard, Visa, American Express and Discover. PayPal does not support Rupay cards at this moment.

List of Indian Banks that support PayPal Payments via Debit and Credit Card:

| Bank name | Credit card | Debit card | Remarks |

| Major premium banks that accept international card payments through PayPal | |||

| Axis Bank | ✔ | ✔ | Fully supported |

| Citibank | ✔ | ✔ | Fully supported |

| HDFC Bank | ✔ | ✔ | Fully supported |

| ICICI Bank | ✔ | ✔ | Fully supported |

| State Bank of India | ✔ | ✖ | No debit card |

| Kotak Mahindra Bank | ✔ | ✔ | Fully supported |

| Other banks that accept international card payments through PayPal | |||

| Andhra Bank | ✔ | ✖ | No debit card |

| Indian Bank | ✔ | ✖ | No debit card |

| Indusind Bank | ✔ | ✔ | Fully supported |

| Jammu & Kashmir Bank | ✔ | ✖ | No debit card |

| Standard Chartered Bank | ✔ | ✔ | Fully supported |

| Vijaya Bank | ✔ | ✖ | No debit card |

| The Ratnakar Bank | ✔ | ✖ | No debit card |

| IDBI Bank | ✔ | ✔ | Visa only |

| Federal Bank | ✔ | ✔ | Fully supported |

| Canara Bank | ✖ | ✖ | Not supported |

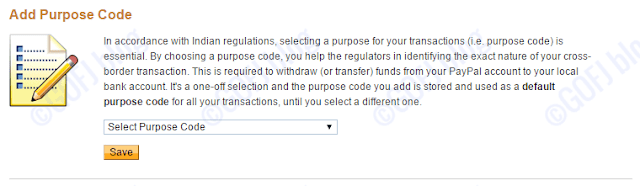

Choosing Purpose Code in PayPal India:

- To make your account fully verified and to receive the payments to India(n) bank account(s), you must add the purpose code.

- Mostly PayPal account is used by the freelancers to receive money. If you’re an online worker or do online jobs on sites like Ysense, Fiverr, etc., freelancers, advertisers or blogger, you can select “Advertising and market research” as purpose code.

- If you sell products, import/export products, offer travel services, you must select the relevant purpose code. Once you select the purpose code, your account will be eligible to withdraw funds to the local bank account(s).

How to Receive Money Through PayPal account in India:

- PayPal is mainly used in India by freelancers, webmasters, small import & exporters, service providers, etc to receive money through PayPal. This section will explain how does PayPal India work when receiving money.

- Once you create the PayPal account, you can use the PayPal email or PayPal.me URL to receive money to your PayPal account. Most of the online companies will ask you for the PayPal email ID to process the payments.

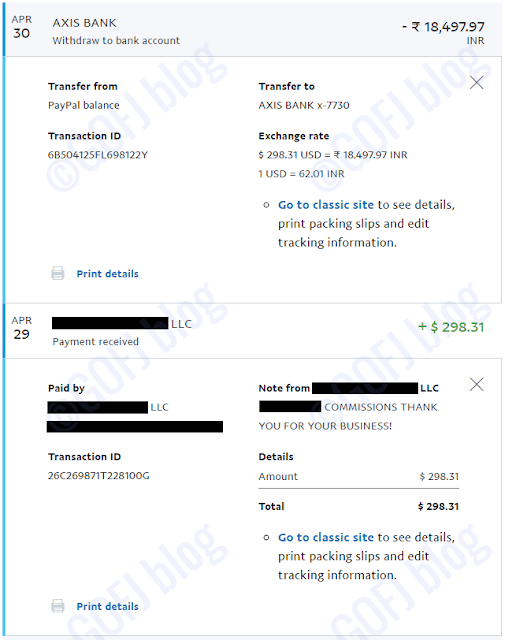

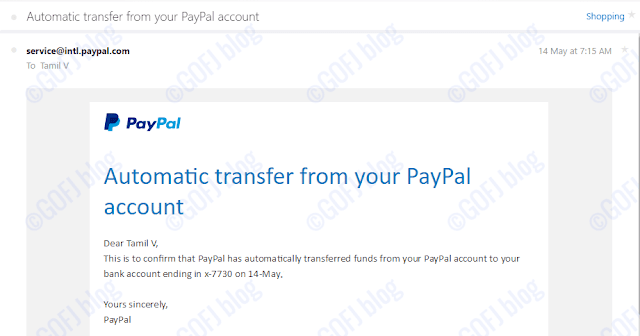

- Here is an example of how does PayPal works when receiving money. When someone or a company sends a payment to the PayPal account, it will be loaded into the PayPal account within a few seconds.

- PayPal will email when the payment is received, as shown above. According to the RBI guidelines, one cannot store money on the PayPal India wallet for more than a week. PayPal will automatically transfer the funds to the bank account linked to the PayPal account.

How Does PayPal Work With Bank Account:

How to Withdraw the Funds to Bank account from PayPal India:

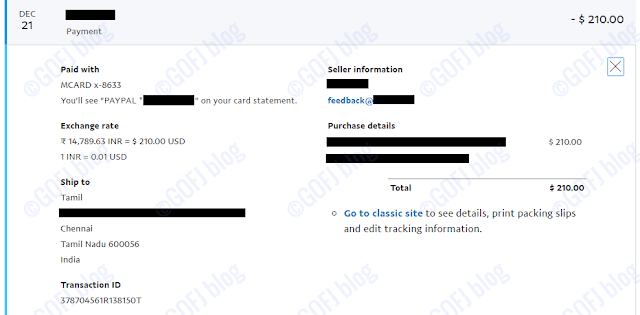

- After the new guidelines set by the PayPal India, no one can store their money on PayPal wallet. Any funds received will be automatically converted to Indian Rupee and deposited in the bank account linked to the PayPal account.

- In the image given above, you can find the amount received to the PayPal account is automatically converted to Indian Rupee equal to the exchange rate on that day.

- After currency conversion, the converted amount will be automatically transferred to the default bank account.

- It will take up to 7 days to see the funds in the bank account transferred by PayPal.

- PayPal will transfer funds using NEFT feature, which will be slower compared to instant fund transfer feature IMPS.

How to Withdraw Money to Indian Bank Accounts Manually:

- Though PayPal will automatically transfer the incoming funds within a few days to the local bank account. You can also manually withdraw funds immediately after receiving funds to transfer money to the bank account as soon as possible.

- Also, the manual withdraws feature helps PayPal India users with more than one bank account linked to their account. Usually, PayPal will begin the transfer to the default bank account. If you wish to withdraw to another bank account, you must use manual withdrawal or you must make the other bank account default.

- You can withdraw total funds to two or more bank accounts manually, while automatic transfer will transfer the entire funds present on the PayPal account to the default bank account.

- To manually withdraw money from the PayPal account, you must click withdraw money and select the bank account. Enter the amount you wish to transfer and click on continue.

PayPal.me – The Simplest way to Receive Money to your PayPal Account:

- The PayPal.me is a premium feature available for all the PayPal users. Using PayPal.me we can ask others to pay just by clicking the URL. PayPal.me helps us to receive money even from a person without a PayPal account.

- The PayPal.me is mostly used by the webmasters and business people who often receive money for their business and services.

- Previously, we have to give our email to the sender or raise an invoice each time to receive money to the PayPal account.

- By using PayPal.me we can create a unique URL and put it on the website or send the email with the URL. So whenever someone wants to pay you, they can do it by clicking the link without contacting the receiver.

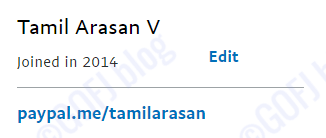

- I’ve created my PayPal.me URL, and it is PayPal.me/tamilarasan and anyone can pay me by clicking the URL.

How to Send Money Using PayPal India:

- The PayPal India users cannot send money directly using the PayPal balance. Instead, we can only pay using the credit or debit cards of the supported bank accounts listed below.

- PayPal will be very helpful to pay international sellers and friends within a few seconds.

- You can send money to by clicking send and request link on PayPal. You should then click pay for goods & services and then enter the email or mobile number of the receiver to send money.

- To make things simple, you can ask the receiver to send their PayPal.me URL so that you can pay money with just a mouse click.

- If you’re paying for products and services to an online company, they will have the “Pay using PayPal” button where you can pay with or without a PayPal account.

- There is a limitation in sending money to others through PayPal. You cannot sometimes send money to another account because of the following reasons: receiver account is not in good standing, receiver account closed, receiver account is under review.

- PayPal India users cannot send payments to anyone in India as per the rules of the Reserve Bank of India.

PayPal India Transaction Fees:

This table will help you find the transaction fee structure of PayPal.

PayPal Fees to Send and Receive Funds:

| Transaction nature | Seller/Receiver | Buyer/Sender | Remarks |

| Personal payments | Free | 2.9% + $0.30 | No |

| Online payments | Varies | 2% up to $20 | Up to $2 [USA] |

| Goods and services | Varies | 2.9% + $0.30 | No |

| Withdrawal fees** | Free | Free | Bank transfer |

| Withdrawal fees** | $1.50 | $1.50 | Check |

| Currency conversion | Varies | Varies | Market price |

| eBay payments | 3.3% + fixed fees | 2.9% + $0.30 | eBay |

| Web payments & invoices | 4.4% + fixed fees | 2.9% + $0.30 | Others |

| **Different withdrawal methods | |||

PayPal India Currency Conversion Fees:

- PayPal will charge us currency conversion fees other than transaction fees whenever we send or receive money.

- Usually, PayPal charges a 3% to 4.4% currency conversion fee.

- Previously, I received money from my PayPal account when $1 = ₹80*. But when PayPal transfers the funds to the bank account, they converted $1 to ₹78*. So PayPal took almost ₹2* as the fee. For example, if we receive $100 to the PayPal account, the actual conversion rate will be ₹8000*, but when we receive funds to the bank account, we might get only ₹7800* after a fee deduction of ₹200*.

- Similarly, if we pay for the products or services, PayPal will charge more than current currency conversion rates, including the fees.

- Previously, I’ve paid an online merchant through PayPal when the actual currency rate was ₹66* for $1. But, while paying, I had to spend about ₹69.50* including the fees. For example, if we purchase a product of price $100 and ₹6600* in Indian Rupee. We must pay about ₹6950* including the fees.

- We have to pay thousands of rupees as fees if we send more money to the merchants from the Indian(n) bank account or receive more money from PayPal to India(n) bank account.

Recommended article – What happened to Payza India?

Link Mobile Number to Enjoy Additional Features:

- The PayPal users must link their mobile number(s) to increase the security and enjoy the additional benefits.

- Linking mobile number will help you receive SMS notification, app notification, increase security, set PIN, add the second-factor security, etc.

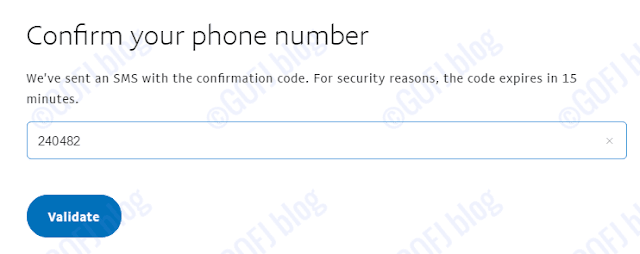

- To add the mobile number, go to the settings and click add the mobile number. Once you enter the mobile number, you will be asked to confirm.

- PayPal will send an SMS with the confirmation code. Enter the confirmation code and click validate. PayPal will display a message that the mobile number is added successfully.

- After adding the mobile number, you can easily log in to your PayPal account using the mobile number instead of email.

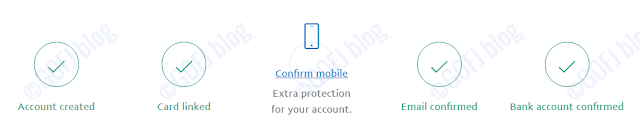

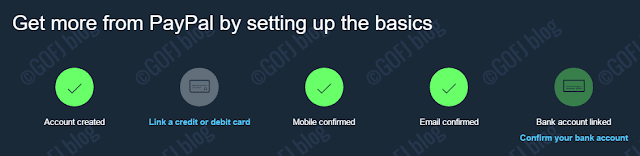

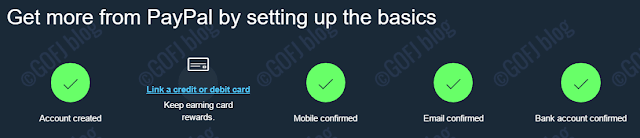

Ensuring the Complete Profile to Enjoy Instant Services on PayPal India:

- Complete your profile 100% to enjoy instant services while sending and receiving funds.

- By linking card details, you can check out faster while sending payments and purchasing products & services.

- Confirming the mobile number will help you protect your account and get notifications about the transactions and account changes.

Recommended article – Earn Bitcoin Online.

PayPal Transactions vs Wire Transactions:

- The PayPal works best for smaller transactions compared to the larger transactions.

- Bank wire transfers will be expensive compared to the PayPal transfers if we transfer money less than $500. In such cases, PayPal will be beneficial.

- PayPal transactions are safer than the bank wire transactions since everything will be under our control.

- Wire transfers are best if we receive more money. We can save a lot of unnecessary fees charged by PayPal.

Limitations in PayPal India Services:

- PayPal India services are only available to the residents of India.

- To use PayPal India, the user must have a bank account in RBI authorized banks.

- PayPal India users cannot send* or receive money without verifying their PayPal account. To verify their PayPal account, the Permanent account number (PAN number) should be added to the PayPal account.

- PayPal users cannot store money on the PayPal India account. Any funds received will be transferred within 7 days to the linked bank account.

- PayPal India account holders cannot use the funds in the PayPal account to pay for others or buy products and services. We can make any outgoing transactions only using credit or debit cards.

- PayPal India users cannot send money to another PayPal India user. This is done to prevent illegal activities.

About PayPal Protection:

- PayPal protection helps Paypal users to make transactions safer and faster.

- PayPal buyer protection protects all the PayPal users who are cheated by the sellers/merchants. So if the buyer doesn’t receive the product or service as promised, PayPal will fully reimburse the product cost and shipping fees. PayPal users do not have to worry about their money while shopping online.

- Similarly, PayPal seller protection protects the sellers from the clients who try to cheat the sellers.

Advantages and Disadvantages of PayPal India:

Pros of PayPal India:

- PayPal is the best payment processor in the world trusted by millions of users.

- PayPal is the only payment processors that reimburses fully for eligible purchase if the seller or buyer cheats.

- PayPal is accepted in over 202 countries.

- PayPal helps the small freelancers to get their earnings to their local bank account with small fees.

- PayPal is the widely used payment processor for online jobs.

- Using PayPal one-click purchase will help us complete the purchases within a few seconds.

- PayPal.me is one of the best features in PayPal to help to receive payment using a mouse click.

- PayPal can transfer a tiny amount which cannot be transferred using wire deposits.

Cons of PayPal India:

- If you’re a freelancer and use PayPal to receive money, you might lose a few percents of your money as transaction fees and currency conversion fees.

- PayPal does not allow us to store money in the wallet in India and a few other countries.

- PayPal does not allow us to purchase using the PayPal balance in India.

- Since PayPal does not allow to store and purchase using the account balance, we have to spend a lot of money as transaction fees and currency conversion fees while purchasing with the debit or credit cards.

- PayPal will not ask for OTP or verified password while making purchases. So, anyone who has access to the PayPal account can make purchases without entering card details and card passwords, since the card is already verified while linking.

Click here to create a new account on PayPal India – PayPal India.

You might also like the comparison – PayPal vs Payoneer.

Recommended article – 15 ways to earn money online.