The online payment processors/services play an important role in processing international e-commerce, freelancing payments, personal transfers within the shortest time. PayPal and Payoneer are the best online payment service in the world. Freelancers who work online to make money completely depend on these payment processors to receive the payments to their local bank account fast and cheap.

The alternative options like wire transfers are really expensive, and small payments cannot be transferred. People used to ask me which is the best among PayPal, Payza, and Payoneer. So, I’ve decided to write this article comparing Paypal vs Payza vs Payoneer. I’ve discussed each part for you to find which is the best among these Global payment services.

Update: Payza was removed from the comparison since their services were stopped. Learn more about Payza services and updates.

About PayPal vs Payoneer Comparison:

- PayPal and Payoneer are compared based on various factors. Each factor is rated from 1 to 10 based on its performance.

- I discussed all the factors in detail and I gave each factor a rating.

- I made the comparison in three sections: general factors, important factors, and critical factors. The critical factors are very important.

PayPal vs Payoneer:

General Factors:

1. Site Design and Layout:

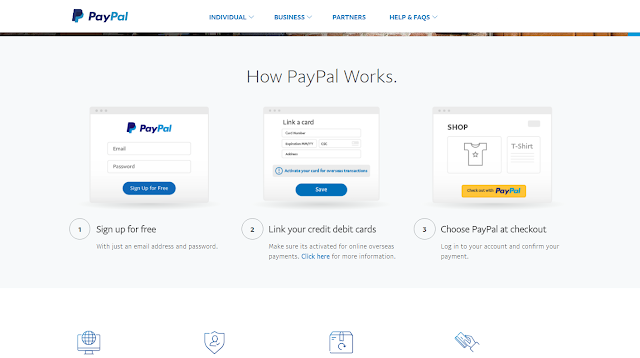

- Neat site design and user-friendly layout are very important for the websites. Sites with poor design and nonuser-friendly will be ignored by the users. The sites discussed here are big companies where they have a high-quality web design. The site designs & layouts are discussed in this section.

- PayPal is the best in site design and layout. Their site is very professional and highly user-friendly. Users can easily find the link to the features. The PayPal lists the incoming, outgoing transactions and invoices on the homepage helps us to easily manage our account. The color, font and other elements on the web page help the basic users to operate their accounts easily.

- The Payoneer has a simple design with not too many features like PayPal and Payza. The new Payoneer users can get confused a little bit to access the inner pages. Members cannot find the transactions on the homepage and the details on the inner page are not as good as its competitors.

Winner: PayPal.

Scores: PayPal – 5 | Payoneer – 3.5.

Important Factors:

In this section, I discussed some of the important factors of online payment services.

2. Account Setup:

- Starting an account on PayPal is very simple. Anyone can start a PayPal account using the email ID. While starting the account, the name should be entered correctly, which cannot be changed without proper documentation. Otherwise, the account will be approved instantly. The PayPal users can immediately pay others using the credit or debit card. However, the account must be verified to receive money for the bank account. The account will become verified we link once the bank account and tax ID to the PayPal account.

- Starting a Payoneer account is tough compared to PayPal and Payza because the Payoneer is highly secure and they do not accept everyone. The Payoneer will manually approve every account. To start a Payoneer account, the user must submit the bank account details while signing up. It might take several days to approve the Payoneer account.

Winner: PayPal.

Scores: PayPal – 5 | Payoneer – 3.6.

3. Linking Bank Accounts and Credit Cards:

- The bank account should be linked to the PayPal account to make the PayPal account completely verified. We should add the bank account after the signup. Linking the bank account to the PayPal account is very simple. To link, the bank account details must be entered and confirmed. PayPal will deposit a small amount in the linked bank account. Once the test amount deposited in the bank account is entered correctly, the account will become verified. We can similarly link the credit card during the signup. The PayPal users can link unlimited bank account and cards to their account.

- We link our bank account to Payoneer during the signup process itself. So, the funds received can be withdrawn into the bank account immediately after starting the account. The Payoneer users should request for the Payoneer Mastercard® to load funds. The Payoneer users cannot link more than one bank account. To change the linked bank account, we must submit the new bank document or voided check leaf. Payoneer is very strict about account security.

Winner: PayPal.

Scores: PayPal – 4 | Payoneer – 3.5.

Recommended article – Bitcoin investment.

Critical Factors:

In this section, critical factors such as transaction, sending & receiving money, withdrawal, speed, feed, etc. are discussed in detail.

4. Receiving Money via PayPal and Payoneer:

- As the online payment service users, people expect to receive money to their account faster. All these payment processors give their best to receive the funds as soon as the sender sends the money.

- The PayPal users can receive the money instantly in their account when the sender sends the money.

- Since the Payoneer loads the money on the receiver account from the sender account, the loading will be instant. However, it might take a few hours to load money on the sender card and send the payment to the receiver.

Winner: PayPal.

Scores: PayPal – 10 | Payoneer – 9.

5. Sending Money via PayPal and Payoneer compared:

- Sending money to other users is an important feature of online payment services. Let us see how these sites perform.

- PayPal allows all users to send money to other PayPal users and companies. However, PayPal does not allow to send money inside their own country in some countries. The PayPal users can use the funds in the wallet or use credit/debit cards to send money to the other users. Also, PayPal does not allow to store/hold funds in the PayPal account in some countries. Such users can send money only using the cards linked to their account.

- There are limitations in sending money to other Payoneer users directly, like we do it on PayPal. Payoneer allows sending money to other Payoneer users only using the Payoneer Mastercard®. Payoneer Mastercard® is not available in all countries. Also, the Payoneer allows only the verified companies to send money without limitations.

Winner: Paypal.

Scores: PayPal – 8 | Payoneer – 5.

6. Withdrawal Fees:

- Not only the internal transaction should be faster but also the bank transfer. The online users love the payment processors that send money to the local bank account at a high speed.

- PayPal transfers the fund to the bank account at a high speed. The withdrawal process varies based on the country. On average, it can take up to 2 – 3 days to complete the bank transfer.

- Payoneer is the best at transferring funds to the local bank account. They transfer funds within a day or two to the local bank account.

Winner: Payoneer.

Scores: PayPal – 8 | Payoneer – 10.

7. Fees (Most important factor):

- The fees are the most important factor of all. While few can pay more for faster payments, many want their transactions to be done for fewer fees, even though the process is done slower.

- PayPal is not a cheaper service to send, receive, transfer and withdraw funds. The PayPal charge transaction fees for almost all the transactions except a few.

- The Payoneer is the cheapest online payment service that collects fewer fees to use their services. The Payoneer collects fees only for specific services.

- Refer to the table given below to learn the fee structure.

Winner: Payoneer.

Scores: PayPal – 7 | Payoneer – 9.

PayPal vs Payoneer Fees Structure Compared:

| Factors | PayPal | Payoneer |

| Sending payments | Free | Free |

| Receiving Payments | 2.90% + $0.30 | Free |

| Currency conversion | 1 – 4.4% | 2% |

| Withdrawal fees | up to 2% | up to 2% |

*Fees may vary across different countries.

The site that pays via PayPal and Payoneer – Ysense.

8. Currency Conversion Fees:

- Most of the online payments are processed in the USD. Many countries do not accept USD deposits and usage of USD. So, the USD should be converted to the local currency. In this section, let see who can do it cheaper for you.

- I’ve used all these payment services where PayPal is costly compared to the other payment processors. There will be a deduction of 2% to 4.4% when the currency conversion is done before the transfer.

- The Payoneer only charges 2% for currency conversion. Payoneer is the cheapest while comparing the three payment services.

Winner: Payoneer.

Scores: PayPal – 7 | Payoneer – 9.

9. Service Availability:

- No matter if the service is the cheapest and fastest. The services should be available widely to make it available to everyone in the world.

- If the service is provided in very few countries, it will not be considered as a reliable one. With this comparison,

- The PayPal services are available in over 200 countries and support 25 currencies.

- The Payoneer is available in over 200 countries and they support 150 currencies, makes it the best payment processor to receive freelance funds all over the world.

Winner: Payoneer.

Scores: PayPal – 9.5 | Payoneer – 10.

10. Product Usage:

- Even if the product is available worldwide, potential customers must use it to send and receive funds. So, product usage is one of the important factors.

- There are over 205 million active PayPal users in the world, makes it the largest online payment service.

- Only 4 million use the Payoneer approved users around the world, makes it the least used payment services among the three.

Winner: PayPal.

Scores: PayPal – 10 | Payoneer – 6.

11. Security Features:

- The security features are an important one for any company or organization. With payment processing, the company should have high-level security. Let’s see how these sites work.

- PayPal is a highly secure payment service in the world. All the transactions are encrypted, so no hackers get us into trouble. The Problem is anyone with the PayPal password can log into the account from the new computer and make transactions if the credit card is linked to the PayPal account. So, PayPal users must protect the password carefully.

- The Payoneer is the most secure of all. When the account holders log in to their account, even they cannot find the full details of their account from Payoneer, as every detail is highly secured. If the account holders log in from a new device, they must verify the device.

Winner: Payoneer.

Scores: PayPal – 9 | Payoneer – 10.

Other Important Factors:

- Payza accepts bitcoin payments while PayPal and Payoneer do not support bitcoins. Payza users can use the bitcoins to pay, send money to other Payza users and convert bitcoins to local currency.

- Payoneer issue their own card to send and receive funds. Payza also issues the card on request.

Final Review on PayPal vs Payoneer:

- PayPal is the widely used payment processor in the world which can be used to send and receive payments instantly. The PayPal charge somewhat higher fees to make transactions and convert currencies. But the transactions are processed faster. PayPal is highly secure.

- Payoneer is the best online payment service that is accepted worldwide. The Payoneer is the fastest, cheapest and highly secure compared to PayPal and Payza. The Payoneer is not user-friendly and they don’t allow us to manage the account settings without proper documentation. On the whole, the Payoneer should be considered first depending on the availability.

Recommended article – Find freelance jobs to receive payments.

PayPal vs Payoneer Comparison Table:

In this section, I compared all the features in the table for review.

PayPal vs Payoneer Scores Compared:

| Factors | PayPal | Payoneer | Winner |

| General Factors comparison list | |||

| Site layout & design | 5 | 3.5 | PayPal |

| Important Factors comparison list | |||

| Account setup | 5 | 3.5 | PayPal |

| Linking bank products | 4 | 3.5 | PayPal |

| Critical Factors comparison list | |||

| Receiving money | 10 | 9 | PayPal |

| Sending money | 8 | 5 | PayPal |

| Withdrawal speed | 8 | 10 | Payoneer |

| Fees structure | 7 | 9 | Payoneer |

| Currency conversion | 9 | 9 | Payoneer |

| Product availability | 9.5 | 10 | Payoneer |

| Product usage | 10 | 5 | PayPal |

| Product security | 9 | 10 | Payoneer |

| 84.5 | 77.5 | PayPal | |

Overall Score Comparison:

This is the final score comparison. When PayPal and Payoneer are compared in various factors, they have scored 84.5, 77.5 respectively. Both two payment services are great and they have the own pros and cons, but PayPal leads in almost all the factors. If I was asked to select the Payment processor to withdraw my money, my first choice would be Payoneer, second choice PayPal. Because Payoneer is cheap and the fastest of all. However, to send payments, PayPal will be my first choice.

To select the payment processor, make short research about their service in your country.

Disclaimer: I write the comparison based on the payment services used in selected countries. Their services vary in each country where their performance, fee structure and other factors might differ from the rating given above. Please be aware. Give your comments to help others in your country.

I hope you have got an idea on PayPal vs Payoneer. Leave your comment sharing personal experience to help others choose the best.

You might also like this – Bitcoin Payments.